In this journal entry, the stock investment account is an asset account on the balance sheet, in which its normal balance is on the debit side. This stock investment can be a long-term asset or a short-term asset based on the purpose of the shares investment that we have made in another company. The company may sometimes make an equity investment in the stock market in order to earn extra revenue to support the business operation. And one common equity investment is purchasing the stock in the capital market. Likewise, the company needs to make the journal entry for the purchase of stock investment when it decides to purchase it as an investment asset.

3 Accounting for the issuance of common stock

The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University. This book uses the Creative Commons Attribution-NonCommercial-ShareAlike License and you must attribute OpenStax. It is possible to get business asset disposal relief (tax at the rate of 10%) if the conditions are met. HMRC CGT manual CG58600P includes all these conditions along with detailed guidance and clearance procedure.

- When a company issues a stock dividend, it distributes additional shares of stock to existing shareholders.

- You can find an accountant near you that has experience using QuickBooks by checking out our Find an Accountant page.

- This will depend on how much ownership the company has in other companies.

- When equity shares are bought solely as a way to store cash in a possibly lucrative spot, the investor has no interest in influencing or controlling the decisions of the other company.

Welcome to Accounting Education

The general rule isto recognize the assets received in exchange for stock at theasset’s fair market value. Stock can be issued in exchange for cash, property, or services provided to the corporation. For example, an investor could give a delivery truck in exchange for a company’s stock. Another investor could provide legal fees in exchange for stock.

Issuing No-Par Common Stock with a Stated Value

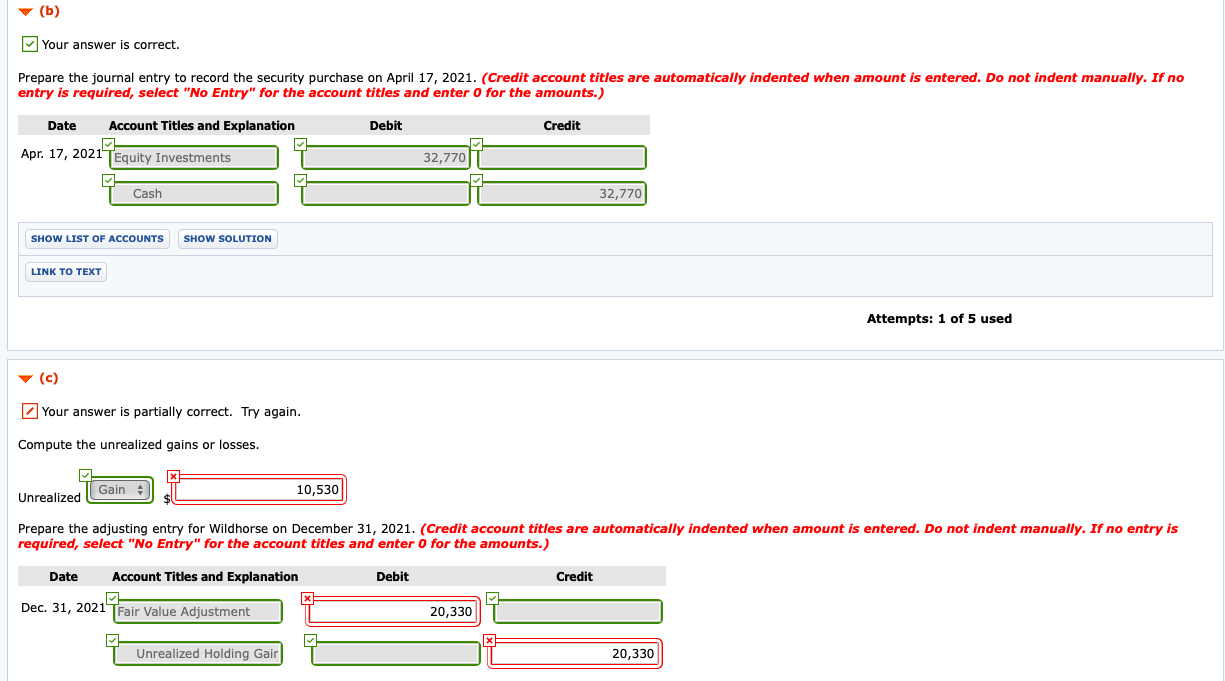

Under the cost method, the company can simply debit the treasury stock account at the amount paid for the purchase. At year-end, this investment (as a trading security) will be reported on the investor’s balance sheet at its fair value of $28,000. On the income statement, both the dividend revenue of $200 and the unrealized gain of $3,000 are shown as increases in net income. For example, we usually record the cash dividend received as the dividend revenue if we have less than 20% of shares of ownership in the investee company.

The company can make the journal entry for purchase of stock investment by debiting the stock investments account and crediting the cash account. A stock dividend distributes shares so that after the distribution, all stockholders have the exact same percentage of ownership that they held prior to the dividend. There are two types of stock dividends—small stock dividends and large stock dividends.

Understanding Stockholders’ Equity

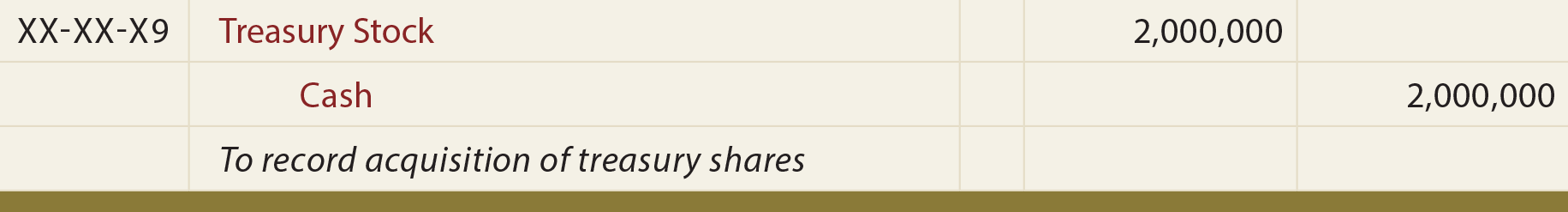

The journal entry to record the declaration of the cash dividends involves a decrease (debit) to Retained Earnings (a stockholders’ equity account) and an increase (credit) to Cash Dividends Payable (a liability account). optimal choice of entity for the qbi deduction Treasury stock transactions have no effect on the number ofshares authorized or issued. Because shares held in treasury arenot outstanding, each treasury stock transaction will impact thenumber of shares outstanding.

On the other hand, we usually need to record the cash dividend received as the reduction of the balance of our stock investment if we have 20% or more shares of the ownership in the investee company. A stock split is much like a large stock dividend in that both are large enough to cause a change in the market price of the stock. Additionally, the split indicates that share value has been increasing, suggesting growth is likely to continue and result in further increase in demand and value. Companies often make the decision to split stock when the stock price has increased enough to be out of line with competitors, and the business wants to continue to offer shares at an attractive price for small investors. Stock can be issued in exchange for cash, property, or servicesprovided to the corporation. For example, an investor could give adelivery truck in exchange for a company’s stock.

According to The MotleyFool, the Walt DisneyCompany bought back 74 million shares in 2016alone. Read the Motley Foolarticle and comment on other options that WaltDisney may have had to obtain financing. You have two choices, either place $10 to an expense account, or incorporate it into the total cost (making it $2010).

A portionof the equity section of the balance sheet just after the two stockissuances by La Cantina will reflect the Common Stock account stockissuances as shown in Figure 14.4. What happens if the price increases from $40 per share to $50 per share tomorrow? Your balance sheet will show the cost of $2010 until the shares are sold or the accounting period ends. Because of the short-term nature of this investment, Valente might sell these shares prior to the end of the year. A gain is reported if more than $25,000 is received while a loss results if the shares are sold for less than $25,000. As with dividend revenue, such gains and losses appear on the owner’s income statement.

A primary motivator of companies invoking reverse splits is to avoid being delisted and taken off a stock exchange for failure to maintain the exchange’s minimum share price. While a company technically has no control over its common stock price, a stock’s market value is often affected by a stock split. When a split occurs, the market value per share is reduced to balance the increase in the number of outstanding shares.

Comments

No Comments